Cross-Sectional Momentum Strategy

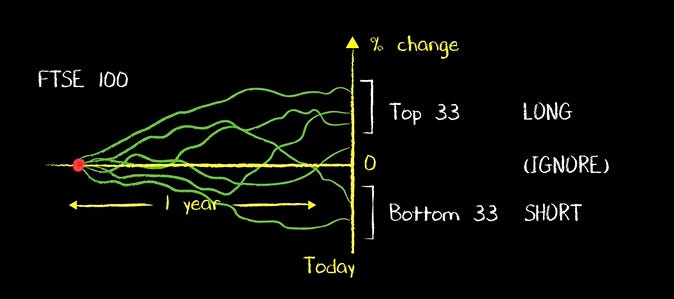

Cross-sectional momentum strategy is a multivariate strategy that looks into the relative performance of a universe of stocks or markets (asset classes).

This strategy believes that to determine whether you should long or short in each individual equity, you shouldn’t only measure its performance in isolation. You should compare its performance to all other equities within a group. Thus, it usually applies to a group of equities.

Instead of only looking at the fluctuations in the market, the cross-sectional momentum strategy identifies winners and losers over some prior period. The data can be used to forecast those relative strength leaders/winners that are expected to outperform the market in the future.

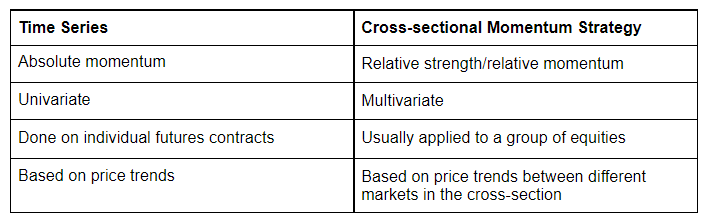

What’s the Difference Between Cross-Sectional Momentum Strategy and Time Series Strategy?

Also known as a trend-following strategy, time series momentum examines the price trend. It takes into consideration the past returns of a security or market as determinants for its future gains. The performance of a security over a lookback period is used to find out whether one should take a long or short position.